Budgeting 101: Budgeting Guide for beginners

Have you ever looked at your bank account a week after payday and wonder what happened to your money? Yeah, me too. The only thing that saved me from overspending and to account for every penny was budgeting. I have laid out a budgeting guide for beginners that has helped me save money, and might be an excellent way for you to account for your money.

Budgeting steps for beginners

Setting a financial goal

The first step to developing a budget is setting a financial goal, the reason for wanting to budget. A financial goal will be your anchor and will keep reminding you why you have taken this budgeting path.

Maybe you want to pay off some debts, buy a car, save more, or even save for a vacation. Your financial goal could be both long term or short term, but you need to have one.

My first financial goal was paying off my student loan. Once I had achieved this, I felt pretty good about myself, so I set another financial goal.

Write down your income, expenses, and savings

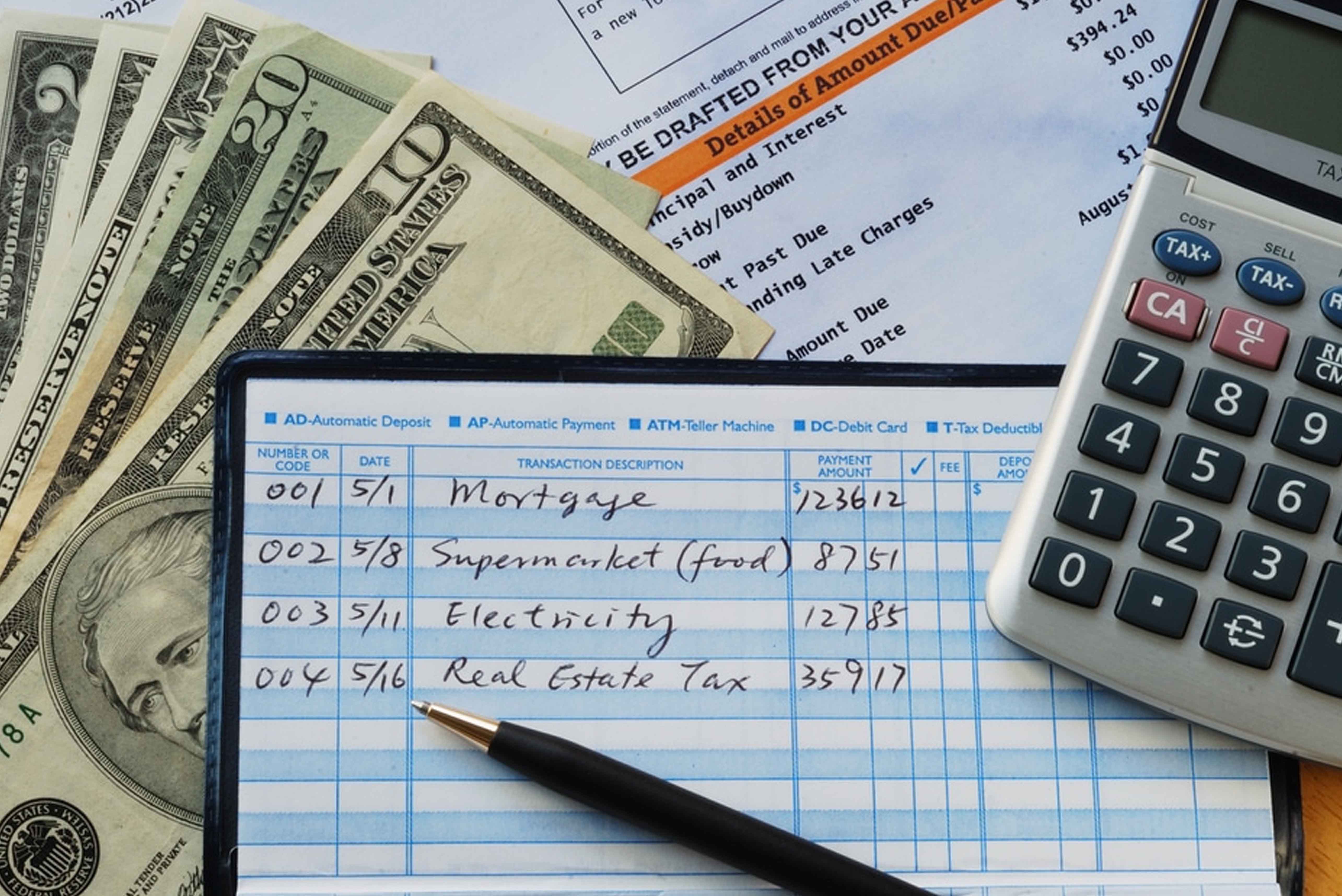

The second is writing down how much money you get and how you spend it.

This means having a template that has all your income, how much you spend and save every month.

Estimates will work in case your income is not constant.

Once you have all the above listed, list all your expenses. Your list must have all the monthly expenses that are a must. Here is a list you can rely on:

- Mortgage or rent payment.

- Living expenses- utilities like electric, gas and water bills, internet, and phone bill.

- Transport costs.

- Insurance payments (car, life, health)

- Groceries

- Childcare

- Debt repayments like credit cards, medical debts, student loans, etc.

Any irregular and non-essential payments like subscriptions, coffee, dinner, gifts, and other miscellaneous payments must also be listed. Any irregular and non-essential payments like subscriptions, coffee, dinner, gifts, and other miscellaneous payments must also be listed. This also means listing down any payments you don’t make every month like taxes and one time fees among others. Add these payments in the month that you pay them. You can also add them up and divide the total by 12, then add the amounts into your monthly payments/ budget.

Once you are done with your expenses, note down your savings. This is where you list down how much you want to save for a short term financial goal, then build up to a long term one and funds for emergencies and investments.

How much you put will depend on how much you have, but remember every penny matters.

Read more on how to save.

Match your expenses with your income

How is your budget looking like now? Are you living within your means, or are you spending more than you are making? Whichever one it is, the third step is adjusting your expenses so that they can match your income.

If you are spending more than you are bringing in every month, cut down your expenses. You can start by eliminating those expenses that you can survive without; like cooking at home rather than dining out, stop using cable companies to watch TV, refinancing your loans, getting DIY gifts, among others.

Do you have some extra cash left after all this?

Well, if that is a yes, then maybe you can use that extra cash to invest or build up an emergency fund. If you have a savings account for your emergencies, then you can set out the extra money to help you get to your financial goal.

Pick a budgeting method

Now that you have all the above in order, it is time for you to pick a budgeting method.

There are many budgeting apps you can use like Pocket Guard, Mint, Mvelopes, and Wally, among others.

Alternatively, you can use the old school ways with the below budgeting methods:

The envelope system- this is where you put money for every expense in an envelope. With this, you will not be using your debit or credit cards to pay for any bills or buy stuff, but withdrawing from an envelope with a predetermined amount for each expense. This method is ideal for overspenders and impulse buyers.

The zero-based budgeting method- If you are trying to pay off some debts as soon as possible, or you live from paycheck to paycheck, then the zero-based budgeting methods is ideal. This method helps you to account for every dollar you have and helps you put aside any extra funds to achieving your financial goals.

The 50/20/30 budgeting method- If you are financially flexible and can cater to your expenses using 50% of your income, then this budgeting method might be right for you. With this method, 50% of your income goes to your expenses, 20% to your debt repayment or savings, and the remaining 30% goes to your spending (like dinner dates, coffee dates, vacations, etc.)

Sticking to the budget

The only way you will succeed and hit that financial goal is sticking to your set budgeting plan.

You will also need to review your plan often and track your progress. In case of anything changes, make adjustments, and keep going.

2 Comments

I have always drawn a budget but this post just made me design it better. Thank you!

You are welcome. Budgets are a necessity for better financial planning.